Enroll Now!

Join 100,000+ Finance Professionals Who Have Transformed Their Careers!

Here's what you get:

- check_circle25+ hours of video tutorials

- check_circle40+ downloadable Excel templates

- check_circleCertificate of completion

- check_circleOne year unlimited access

- check_circlePriority online support

Billing Information

00

Days

:

00

Hours

:

00

Minutes

:

00

Seconds

100% safe & secure

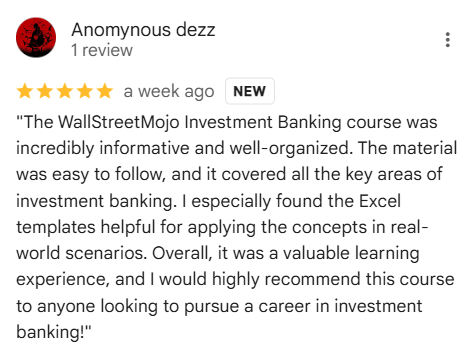

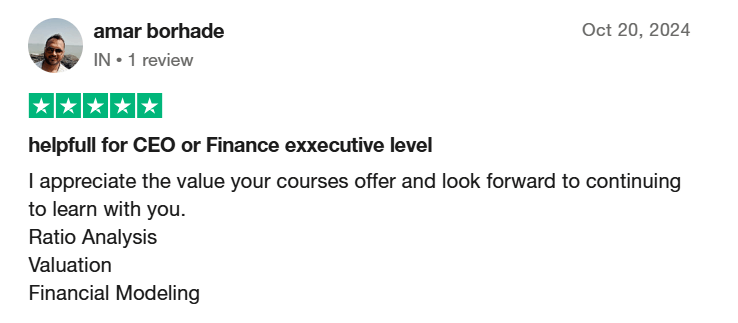

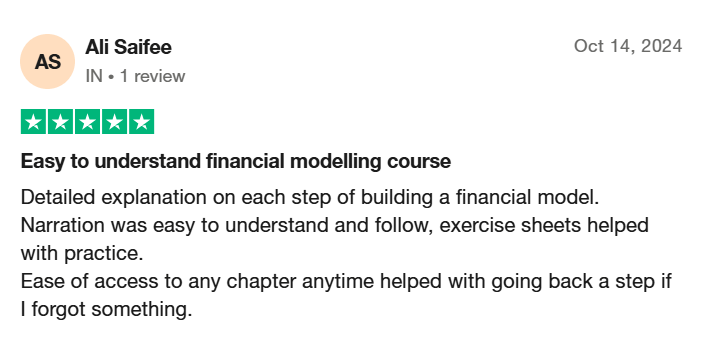

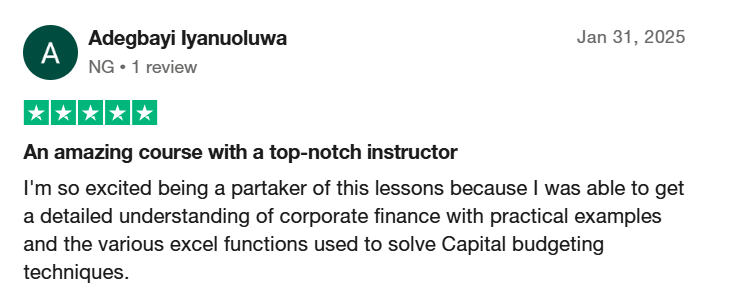

People Just Like You Took The Next Step Towards Their Goals....

Frequently Asked Questions

Got questions? We have got answers

Q. What is financial modeling and valuation, and why are they important in finance?

The Financial Modeling And Valuation course is a bundle course comprising both financial modeling and company valuation topics. It provides hands-on learning experience on how to perform financial modeling for company statements and forecasting the financial items as well. Also, it helps in determining the company’s actual value by performing various valuation analyses as well. In short, it serves as an ultimate guide for becoming a financial or equity analyst.

Q. What topics are covered in a Financial Modeling And Valuation course?

The outline of the Financial Modeling And Valuation course online provides a list of multiple topics revolving around the concept of modeling and company valuation. It includes revenue forecast, costs forecast, debt and equity forecast, working capital forecast, cash flows forecast, depreciation and amortization forecasts, and statement forecasts.You also learn about various valuation topics like the Dividend Discount Model (DDM), Discounted Cash Flow (DCF), and relative valuation model. Plus, you can explore sensitivity analysis by learning about its application with real-world examples in the curriculum.

Q. Can Financial Modeling And Valuation training help in performing company valuations?

Definitely, our Financial Modeling and Valuation analyst certification is made to help you get certified to perform company valuations. This means that with the skills acquired through this course, you can identify the actual worth of the company. Thus, investments made or planned in the future can be assessed with this valuation technique. It also proves beneficial during mergers and acquisitions.

Q. Are there any networking opportunities or professional associations for individuals with Financial Modeling And Valuation skills?

Yes, our Financial Modeling And Valuation analyst certification program does provide you with immense career and networking opportunities. With the knowledge gained from this course, you can connect to people in the same industry (or field) for connections. Likewise, you can also add this certification to your LinkedIn profile and find people in your field interacting with you!

Email us at support@wallstreetmojo.com