Finance Career Launchpad: Get Wall Street Analyst Level training in 2 months!: Discount Closing Forever in

Finance Career Launchpad: Get Wall Street Analyst Level training in 2 months!: Exclusive Discount Closing Forever in

700+ 5 Star Reviews Across Platforms (Most Trusted Learning Platform)

Your Shortcut to a High-Paying Finance Career Starts Here

Finance Career Launchpad: Get Wall Street Analyst Level training in 2 months!

...

Perfect for professionals, freshers and even students!

What This Program Is About?

2-Month Wall Street Program: Learn financial modeling with live bootcamp, real project work, and expert mentorship.

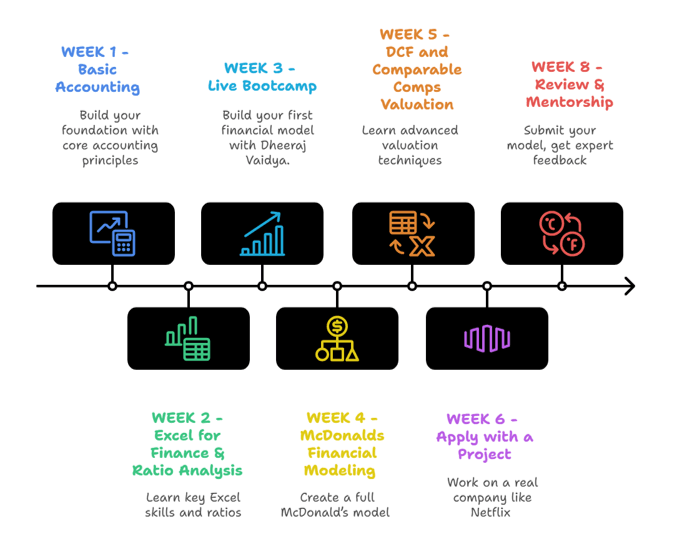

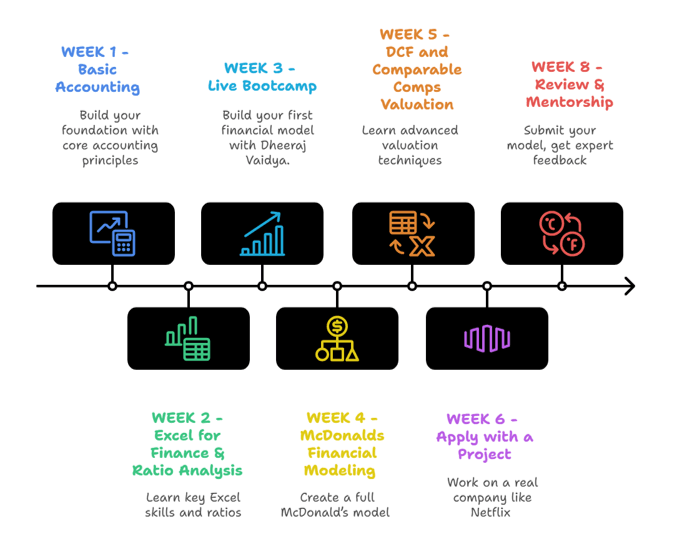

8-Week Roadmap:

Master core concepts through structured modules — accounting, Excel, ratios, DCF, comparables, and more.

Live Bootcamp Experience:

Build a full financial model from scratch with expert-led sessions by Dheeraj Vaidya.

Mentorship & Review of Project:

Get personalized mentorship and detailed feedback on your final project to sharpen your skills.

Just 2 Hours a Day:

Build job-ready finance skills with focused, actionable learning.

Real Work Examples:

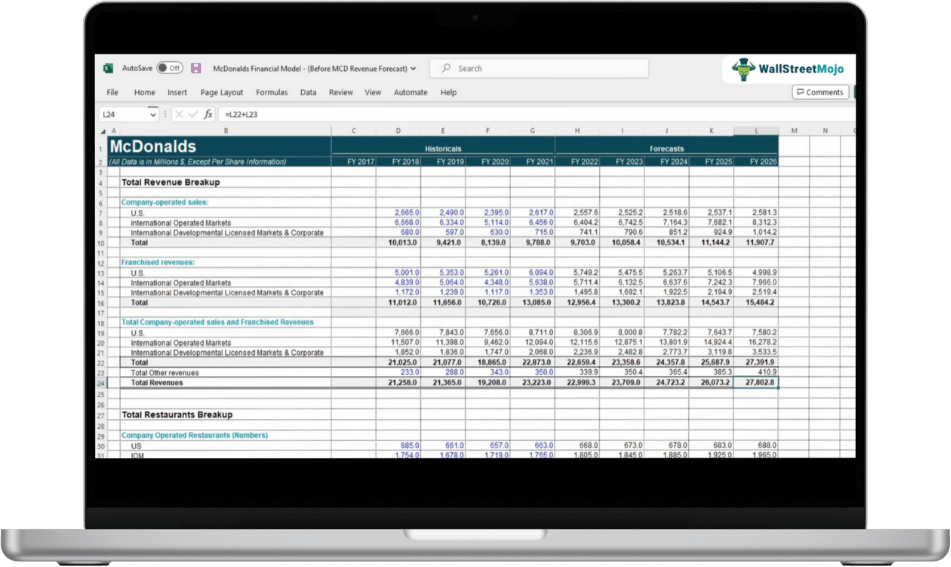

Practice with real company data — including a full financial model of McDonald’s.

$2399 Worth of Resources:

Get premium templates, tools, and extra courses to accelerate your job prep.

Finance Career Launchpad

A Rare Combination Of Expert Created Training + Real-World Case Studies + Exclusive Bonuses + Proven Framework

100,000+ Students Enrolled

700+ 5 Star Reviews Across Platforms (Most Trusted Learning Platform)

Your Shortcut to a High-Paying Finance Career Starts Here

Finance Career Launchpad: Get Wall Street Analyst Level training in 2 months! ...

Even with Zero Experience!"

What This Program Is About?

2-Month Intensive Program: Learn financial modeling with live bootcamp, real project work, and expert mentorship.

8-Week Roadmap:

Master core concepts through structured modules — accounting, Excel, ratios, DCF, comparables, and more.

Live Bootcamp Experience:

Build a full financial model from scratch with expert-led sessions by Dheeraj Vaidya.

Mentorship & Review of Project:

Get personalized mentorship and detailed feedback on your final project to sharpen your skills.

Just 2 Hours a Day:

Build job-ready finance skills with focused, actionable learning.

Real Work Examples:

Practice with real company data — including a full financial model of McDonald’s.

$2399 Worth of Resources:

Get premium templates, tools, and extra courses to accelerate your job prep.

Finance Career Launchpad

A Rare Combination Of Expert Created Training + Real-World Case Studies + Exclusive Bonuses + Proven Framework

100,000+ Students Enrolled

Exclusive Limited Time Opportunity

Get 90% OFF (Today Only!)

Offer Includes All Bonuses Worth $2399 Ending In ...

This Offer has Expired.

Hurry Up!

CLAIM YOUR SPECIAL BENEFITS WORTH $2399!

2+ Hours Of Basic Accounting Lessons (Value: $73)

Learn Basics of Accounting in Just 2 Hours - Familiarize yourself with accounting fundamentals and accounting treatments in financial statements.

5+ Hours Of Fundamental Ratio Analysis Course (Value: $198)

Understand profitability, liquidity & solvency ratios with real-world case studies and hands-on training in Excel for ratio calculations & financial analysis.

6+ Hours Of Excel For Finance Lessons (Value: $198)

Learn Excel finance with in-depth analysis of basic to professional skills, commands, formulas and reporting of financial figures, values and variables in Excel.

Master Financial Statements Like a Pro (Value: $73)

Instantly access pre-built financial models, valuation frameworks, and forecasting tools used by investment bankers, analysts, and finance professionals worldwide.

Live Financial Modeling Bootcamp – 2 Days

(Value: $495)

Build a real-world financial model live with Dheeraj Vaidya. Learn step-by-step exactly how analysts are trained at top finance firms.

Exclusive McDonald's Financial Model (Benefits Included)

Get your hands on a fully built, step-by-step model covering revenue forecasting, cost projections, working capital, shareholder equity, and valuation techniques—a ready-to-use blueprint for real-world application.

13+ Hours Complete Financial Modeling Journey (Value: $198)

Go from zero to expert with a step-by-step approach covering everything from basic accounting to advanced valuation techniques used by Wall Street professionals.

4+ Hours Of Trading Comps Valuation (Value: $123)

Decode the metrics of relative valuation with our Trading Comps Valuation Course. Learn to evaluate if a company is worth the investments planned.

10+ Hours DCF

& Valuation Techniques (Value: $123)

Become an expert in Discounted Cash Flow (DCF), Dividend Discount Models (DDM), and advanced valuation techniques to confidently assess any business.

Project Work – Build Financial Model (Benefits Included)

Apply skills to a real world project like Netflix and build its financial model from scratch

11+ Hours of Finance for Non-Finance Managers Course (Value: $248)

Understand financial statements, budgeting, and key business decisions without needing a finance background.

11+ Financial Planning & Analysis Course

(Value: $245)

Gain budgeting, forecasting, and performance analysis skills used by global finance teams.

40+ Premium Excel Templates (Benefits Included)

Instantly access pre-built financial models, valuation frameworks, and forecasting tools used by investment bankers, analysts, and finance professionals worldwide.

Exclusive Career Benefits & Certifications (Benefits Included)

Gain high-value skills in Excel modeling, financial ratios, and forecasting techniques used by top hedge funds, private equity firms, and Fortune 500 companies.

Industry Expert Instructor

Dheeraj Vaidya, CFA, FRM

- IIT Delhi & IIM Lucknow Alumnus

- Ex-JP Morgan & CLSA Equity Analyst, Bennet Coleman, Adventity

- 20+ Years of Training Experience

- Trained students and professionals globally across esteemed organizations like, IIM Lucknow, FMS Delhi, IIM Mumbai, JPMorgan, CRISIL and more.

- Dheeraj has led 100+ live and virtual Seminars for students and professional.

WallStreetMojo was co-founded by Dheeraj Vaidya CFA, FRM. A former J.P.Morgan and CLSA Equity Analyst, Dheeraj specializes in financial modeling, forecasting, and valuations. In his career spanning almost two decades, he has trained and mentored more than 100,000 students and professionals on a range of topics, including investment banking, private equity, accounting, and more.

Who Can Take This Course?

Students

Investors and Analysts

Working Professionals

Entrepreneurs and Small Business Owners

Managers and Decision-Makers

Finance Enthusiasts

Career Launchpad Sample Videos

Discounted Cash Flow (DCF)

McDonald's (MCD) Debt Forecast

MCD Working Capital (WC)

MCD Revenue Forecast

MCD Other Long Term Assets & Liabilities

Relative Valuation (PEG Ratio Application)

Relative Valuation (EV to EBIT)

Enterprise Value & Equity Value Multiples

Self-Paced Course

Learn at your own pace with pre-recorded course modules.

Excel Skills

Familiarity with popular applications, like Excel

1 - Year Access

Get unlimited access to course conetent and collaterals for 1 year

LIVE Classes

Learn directly from Industry Expert Instructors

Certification

Get Online Certification Upon Course Completion.

Excel Templates

Downloadable case study documents and unsolved & unsolved Excel templates.

Top Companies That Hire Professionals With Financial Modeling Skills

WallStreetMojo in Numbers

100k+

Learners

30+

countries

10+

Expert Instructors

650k+

Subscribers

150k+

Social Media Reach

1.01M+

Visitors every month

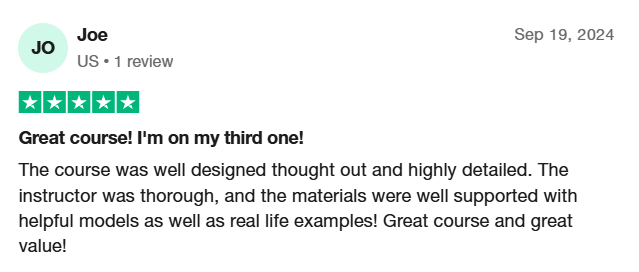

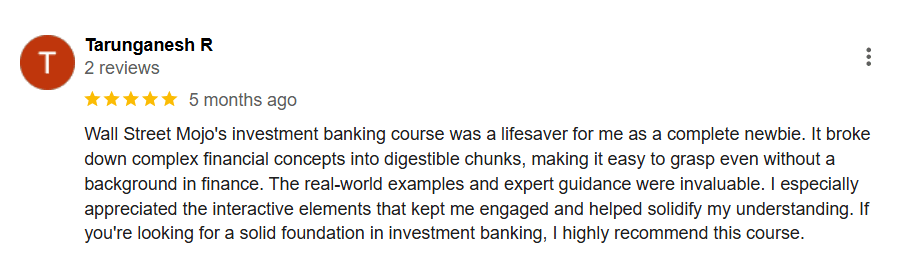

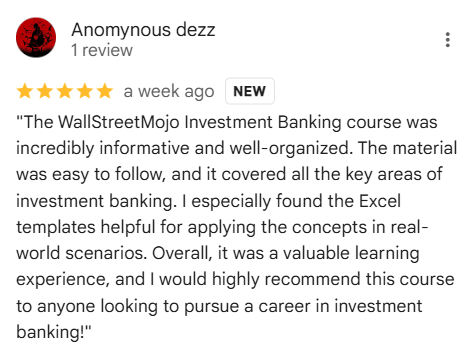

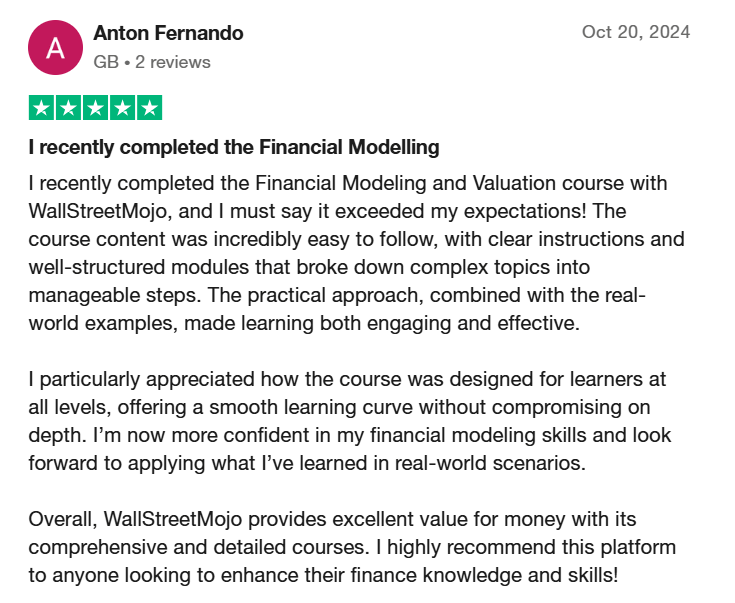

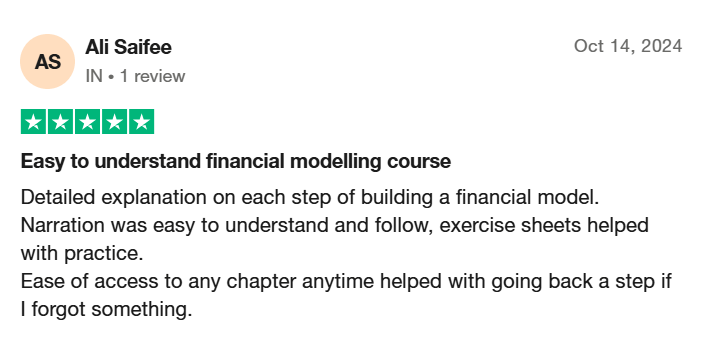

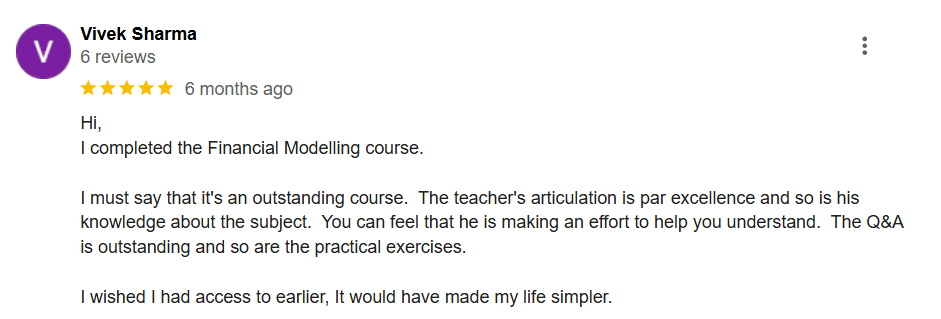

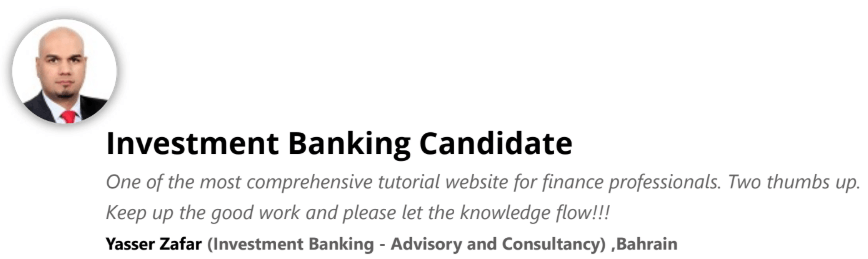

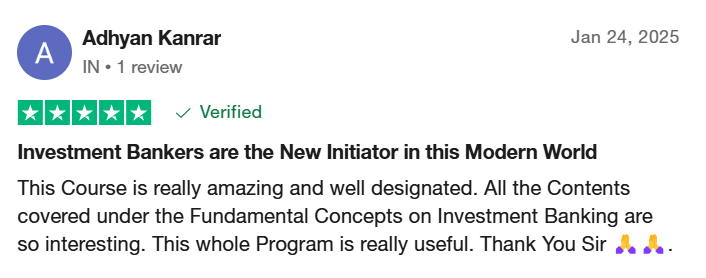

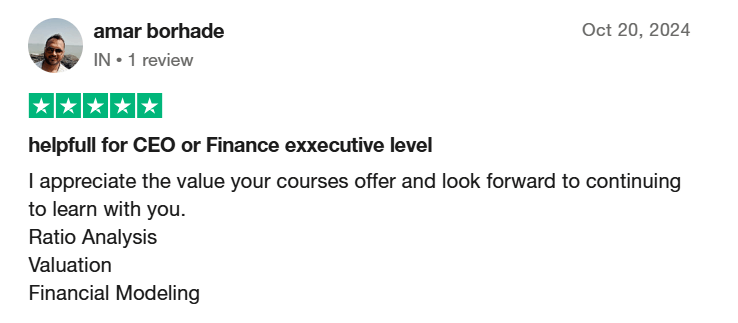

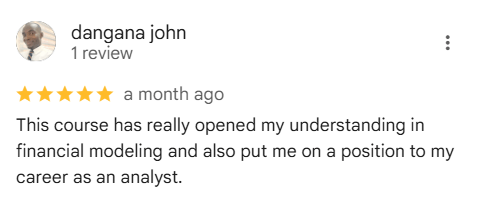

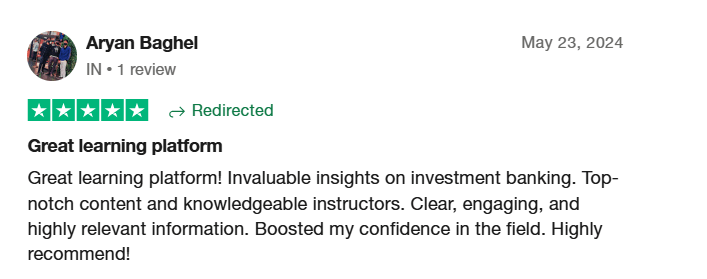

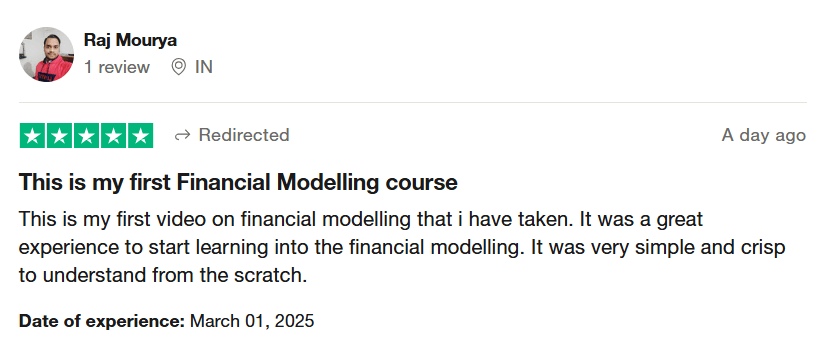

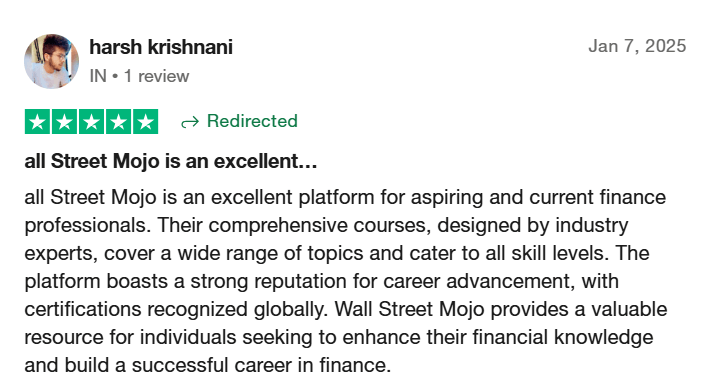

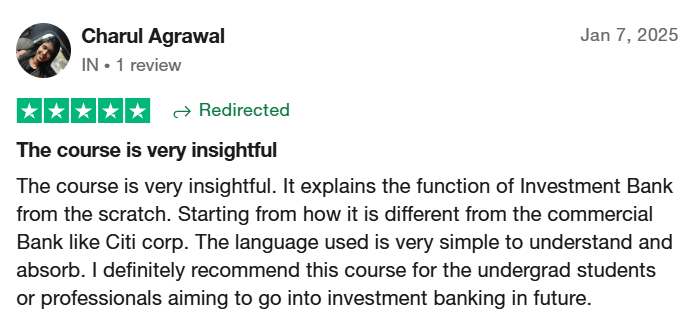

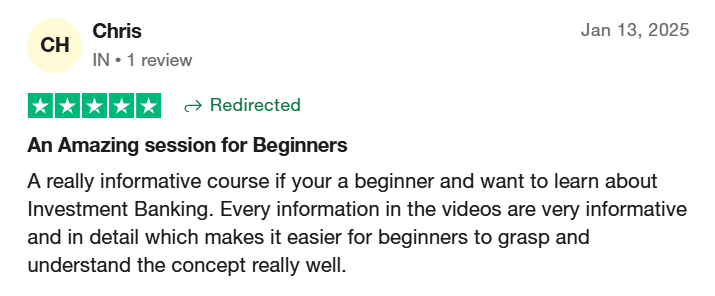

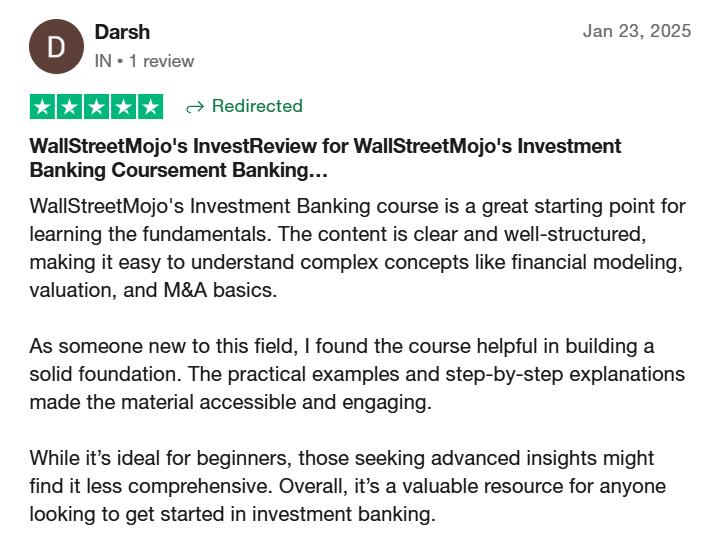

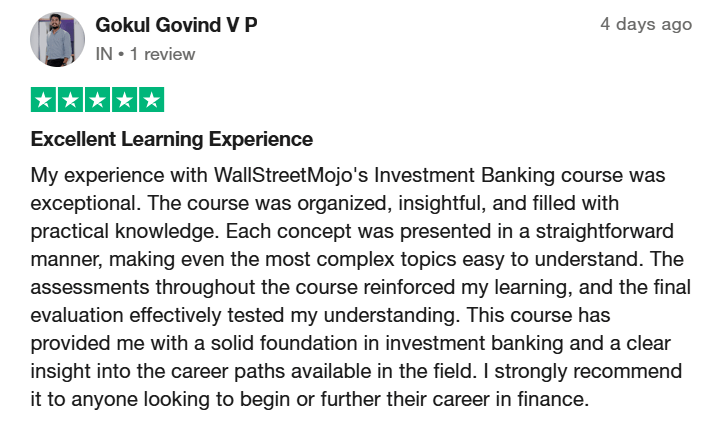

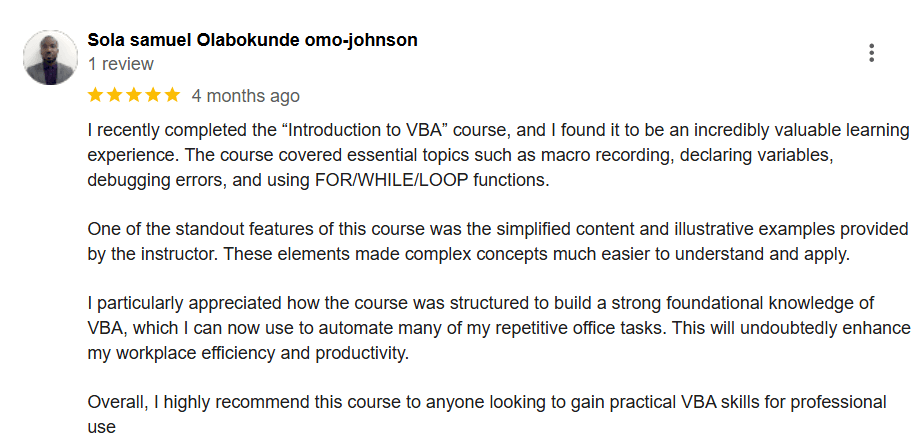

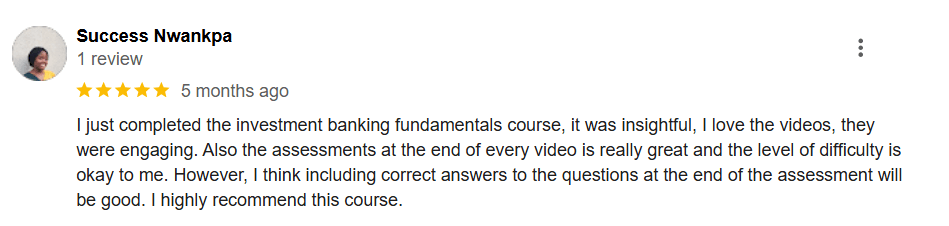

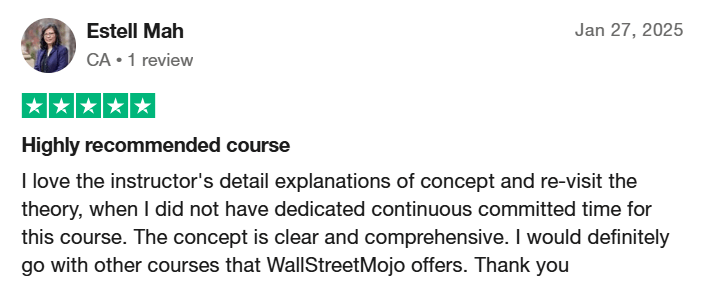

TESTIMONIALS - What Our Learners Are Saying...

Don't just take our word for it...here's what our learners have to say....

Exclusive Limited Time Opportunity

Get 90% OFF (Today Only!)

Offer Includes All Bonuses Worth $900+ Ending In ...

This Offer has Expired.

Frequently Asked Questions (FAQs)

Who is this bundle ideal for?

This program is perfect for commerce and non-commerce students, recent graduates, and early-career professionals looking to build core finance skills and land an analyst role.

Do I need prior finance knowledge to enroll?

No! The bundle is structured to take you from basic accounting and Excel to advanced financial modeling and valuation. Add-ons like FFNF are specifically designed for absolute beginners.

What does the bundle include?

You get access to 7 essential finance courses as part of the Starter Plan:

(1) Basic Accounting

(2) Excel for Finance

(3) Ratio Analysis

(4) Financial Modeling 101

(5) Financial Modeling

(6) Trading Comp Valuation

(7) DCF Modeling

In addition to the above courses, you can also get access to expert-led BOOTCAMP, Mentorship, FFNF, and FP&A sessions under the Pro & Elite Plans.

What is the difference between the STARTER, PRO & ELITE Plans?

We have three different plans, giving learners the flexibility to choose according to their convenience and career goals:

✅ Starter (Ideal for Self-Paced Learners) – Just need the course and want to learn at your own pace.

🚀 Pro (Ideal for Learners Who Want Live Training) – Want expert-led LIVE Bootcamp to build skills faster.

🏆 Elite (Ideal for Serious Aspirants Seeking Expert Guidance) – Want it ALL: Bootcamp + Mentorship + Add-ons for a job-ready transformation

How long will it take to complete the bundle?

The core bundle is designed to be completed in around 6–8 weeks with consistent effort. You can move at your own pace and revisit lessons anytime.

Is this a certificate course?

Yes, you’ll receive individual certificates for each course, as well as a comprehensive certification upon completing the full bundle—recognized by employers and finance professionals.

What if I am from a non-commerce or non-finance background?

No problem at all. The bundle starts from the very basics. The FINANCE FOR NON-FINANCE add-on is specifically created to help non-finance learners understand foundational finance before diving into advanced topics.

Will this help me get a job in finance?

Absolutely. This bundle is tailored to help you build job-ready skills in Excel, valuation, and modeling—exactly what hiring managers look for in analysts. Many learners have used it to land internships and full-time roles in finance.

Can I access the content anytime, or is it live only?

The courses are completely self-paced and available 24/7. Add-ons like BOOTCAMP and Mentorship include live sessions and guidance, scheduled in advance.

Will I get access to downloadable resources or templates?

Yes! Each course includes downloadable Excel templates, practice files, case studies, and cheat sheets that you can use to practice and apply what you learn.

What topics are covered in a Financial Modeling And Valuation course?

The outline of the Financial Modeling And Valuation course online provides a list of multiple topics revolving around the concept of modeling and company valuation. It includes revenue forecast, costs forecast, debt and equity forecast, working capital forecast, cash flows forecast, depreciation and amortization forecasts, and statement forecasts.

You also learn about various valuation topics like the Dividend Discount Model (DDM), Discounted Cash Flow (DCF), and relative valuation model. Plus, you can explore sensitivity analysis by learning about its application with real-world examples in the curriculum.

Can Financial Modeling And Valuation training help in performing company valuations?

Definitely, our Financial Modeling and Valuation analyst certification is made to help you get certified to perform company valuations. This means that with the skills acquired through this course, you can identify the actual worth of the company. Thus, investments made or planned in the future can be assessed with this valuation technique. It also proves beneficial during mergers and acquisitions.

Are there any networking opportunities or professional associations for individuals with Financial Modeling And Valuation skills?

Yes, our Financial Modeling And Valuation analyst certification program does provide you with immense career and networking opportunities. With the knowledge gained from this course, you can connect to people in the same industry (or field) for connections. Likewise, you can also add this certification to your LinkedIn profile and find people in your field interacting with you!

How can I apply the concepts learned in Financial Modeling And Valuation to my current job role?

The skills obtained from the Financial Modeling And Valuation FMVA certification are an absolute toolkit for learners to excel in their current jobs. Using financial statement analysis and financial ratios, you can improve the efficiency of investment decisions and develop more detailed financial models. Also, you can enhance the existing budget processes with the forecasts obtained from the model data and properly value the company’s investments.

What are the benefits of obtaining a Financial Modeling And Valuation certification?

This certification program offers You, as a finance professional, multiple benefits for finance professionals. It includes expertise in the forecasting techniques to analyze and interpret the company’s financials. Also, with the valuation methods explained, you can evaluate the company's performance and determine the actual net worth.

Additionally, also have an analytical mindset developed to make a comparative valuation analysis of firms in the same industry. Not only that, but you also receive an upper hand in understanding the impact of internal factors on the price during transaction deals (mergers and acquisitions).

Can Financial Modeling And Valuation skills be applied across different sectors or industries?

The Financial Modeling And Valuation training course can definitely be applied to different industries and sectors. With the calculation-based examples and case studies like McDonald’s provided in the course, you can take any other company and develop forecasts for their performance as well. However, while using the valuation model, it must be modified and adjusted to that industry and then performed. As every firm has a different way of operations, the valuation approach also changes.

Is there a certification available for completing a Financial Modeling And Valuation course?

Our Financial Modeling And Valuation analyst course bundle does provide certification. After the completion of the course, learners need to clear the final assessment to receive the certificate. It can later be added to your resume and LinkedIn profile to grab better career opportunities. This certificate validates your knowledge of the core subject and is visible only after completing the course.

How can I gain practical experience in financial modeling and valuation?

The case studies and real-world examples explained in this course help you in understanding the practical application of the concept. You can learn to relate the model to the industry giants and how financial analysts perform modeling and valuation in real. In addition, you get familiar with the popular tips and tricks used in model preparation and sensitivity analysis.

What are the common challenges faced by individuals learning financial modeling and valuation?

Financial modelers and valuation analysts often face certain challenges while preparing financial models. These include insufficient data, data quality, and accuracy. In the later stages, issues with the model complexity and assumptions made are also common. Likewise, if assumptions turn wrong, the forecast made also changes and may have a major impact on the company’s decisions.

Trusted And Recommended By LEARNERS From:

Trusted And Recommended By LEARNERS From:

Finance Webinars & Classes Conducted

Learn Career Enhancing Skills, From Anywhere On The Planet

Email us at support@wallstreetmojo.com

Follow us for Finance content and insights